93% of payday loan borrowers regret taking out their loans, survey finds

Payday loans can be a debt trap for borrowers who can't afford to make payments. Here's how you can repay your payday loan balance before it's sent to debt collectors. (iStock)

Payday lenders prey on borrowers with bad credit who desperately need money, trapping them in a cycle of high-interest debt that's difficult to repay.

The vast majority (93%) of borrowers regret taking out their payday loan, according to a new survey from DebtHammer. Just 1% of respondents said their financial situations improved after borrowing a payday loan, while 84% said they were worse off.

Payday loans give consumers an avenue to borrow small, short-term cash loans without a credit check. But the typical repayment period is just two weeks, which leads 4 in 5 borrowers to borrow a new payday loan to repay their current debt, the Consumer Financial Protection Bureau (CFPB) reported.

It's possible to get out of payday loan debt without renewing your loan and incurring additional fees. Keep reading to learn how to break the cycle of payday loan borrowing, such as consolidating debt with a personal loan. You can compare rates on debt consolidation loans for free on Credible without impacting your credit score.

BEST SHORT-TERM LOANS: COMPARE YOUR OPTIONS

3 ways to get out of a payday loan

The average cost of a payday loan is equivalent to an annual percentage rate (APR) of nearly 400% — in other words, borrowers who keep rolling over their payday loans could pay 4x the amount they originally borrowed over the course of a year.

Payday lenders may have you think that rolling over your loan is the only way to pay off your debt, but that's not the case. Here are a few alternative ways to break the payday loan cycle:

Read about each repayment plan in the sections below.

3 THINGS YOU SHOULD NEVER DO WITH YOUR EMERGENCY FUND

1. Debt consolidation loans

Personal loans are lump-sum loans that are commonly used to consolidate more high-interest debt, such as payday loan debt. They come with fixed interest rates and repayment terms, which means that your monthly payments will be the same while you repay your debt.

These debt consolidation loans are typically unsecured, which means that you don't have to put up an asset as collateral. Because they're unsecured, lenders determine your interest rate and eligibility based on your credit score and debt-to-income ratio.

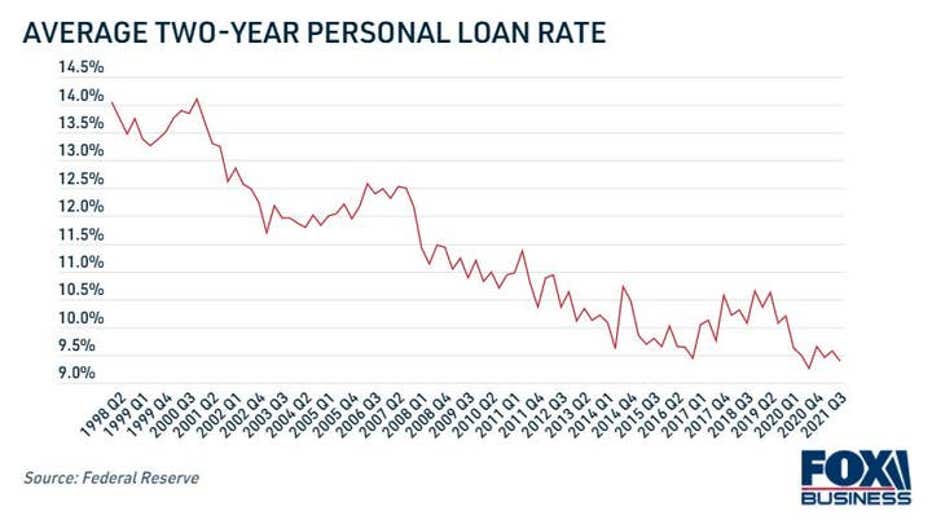

Well-qualified borrowers may qualify for a low rate on a personal loan for debt consolidation. Personal loan rates are near all-time lows, according to the Federal Reserve, averaging 9.39% in Q3 2021.

Some credit unions also offer small payday alternative loans (PALs), which allow members to borrow up to $2,000 with an interest rate cap of 28%. However, these loans can be difficult to find since just a small portion of credit unions offer PALs.

You can see if you qualify for a debt consolidation loan on Credible with a soft credit inquiry, which won't impact your credit score. Use a personal loan calculator to estimate your monthly payments to see if this option can help you get out of payday loan debt.

CREDIT CARD INTEREST RATES SPIKE TO NEAR ALL-TIME HIGH, FED DATA SHOWS

2. Extended payment plans

An extended payment plan (EPP) lets payday loan borrowers repay their debt over a longer time than the typical two-week repayment term. Many states require payday lenders to offer EPPs, so you'll have to research your state laws to see if you're eligible.

Some payday lenders may offer EPPs regardless of whether they're required to do so by law. Lenders belonging to the Community Financial Services Association of America (CFSA) are required to offer EPPs to borrowers, but other financial institutions may not provide this option.

HOW LONG DO NEGATIVE ITEMS STAY ON YOUR CREDIT REPORT?

3. Credit counseling

Nonprofit credit counseling agencies offer free or low-cost services for borrowers who are struggling to manage their debt. One of these services includes enrolling payday loan borrowers in a debt management plan (DMP).

Under a DMP, a credit counselor will help you create a budget and debt repayment schedule. Credit counselors may be able to help you negotiate with payday lenders to lock in a lower interest rate or reduce the loan amount.

You can see a full list of certified nonprofit credit counselors on the Department of Justice website. If you still have questions about payday loan debt relief, learn more about debt consolidation by getting in touch with a knowledgeable loan officer on Credible.

BORROWERS WHO CONSOLIDATE CREDIT CARD DEBT CAN SAVE $2K+ ON AVERAGE, DATA SHOWS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.